Years-Long Ban Now Fully Enforced

The fallout from the reignited tensions between India and Pakistan—this time, with direct consequences for the rock salt and soda ash markets.

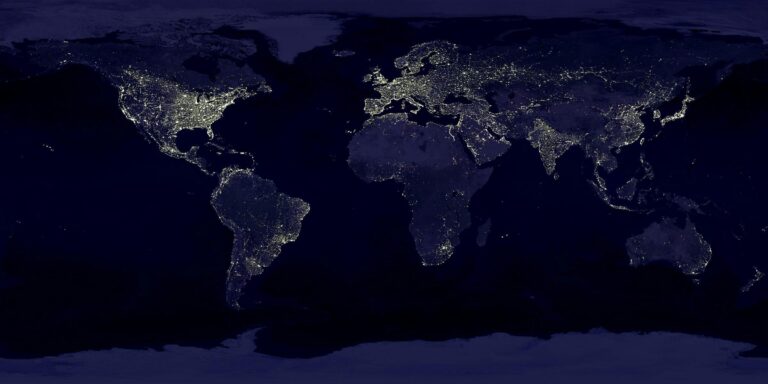

While a full trade ban has technically been in place since 2019, enforcement gaps allowed limited imports to continue through indirect routes, particularly via the UAE, Sri Lanka, Indonesia, and Singapore. These countries acted as repackaging and relabeling hubs, enabling Pakistani-origin products to enter Indian markets under alternative origin labels.

Now, in response to the latest diplomatic escalation, India has tightened customs regulations to block all indirect imports, effectively reducing trade volumes to zero. This marks the closure of a loophole that had kept the flow of key Pakistani materials alive, despite official restrictions.

Market Realignment in Motion

Before the recent escalation, India’s imports from Pakistan had already dwindled to just $0.42 million between April 2024 and January 2025—largely limited to niche items like Himalayan salt. Analysts suggest this latest action may mark the final phase in a gradual but decisive shift.

With official trade routes fully closed, domestic and alternative international sources for rock salt are now under increased demand. Industry players and policymakers are watching closely as the market adjusts

Crackdown on Indirect Salt Imports

Despite the ban, an estimated $500 million worth of goods—including Pakistani salt—has continued to enter India via intermediary countries such as the UAE, Sri Lanka, Indonesia, and Singapore. These nations are allegedly acting as repackaging and relabeling hubs to bypass direct trade restrictions.

The Indian government has now expanded the embargo to cover indirect imports, empowering customs authorities to identify and block salt products of Pakistani origin. This move is aimed at halting circumvention tactics and tightening enforcement across ports and borders.

Himalayan Salt Prices Double in Days

In markets like Agra, the wholesale price of Himalayan rock salt has jumped from ₹26 ($0,30) per kg to ₹50–₹55 ($0,58-$0,64) per kg. Retailers report a wave of panic buying, with households purchasing in bulk.

Though rock salt isn’t a staple commodity, its cultural, spiritual, and industrial roles in India—ranging from fasting rituals to wellness applications—have magnified the perception of scarcity.